If you are traveling outside of the U.S. or to a remote location, medical evacuation insurance can be a crucial part of your trip planning. Unfortunately, most domestic health insurance does not cover all overseas care or transportation costs. Medical evacuation costs can be extensive, especially when you are away from home, in a hard-to-access area, or have a health condition requiring specialized care.

Medical evacuation insurance covers these costs for a fraction of the expenses you would pay otherwise. It can offer valuable peace of mind and protection from unexpected medical debt from your travels. It can also provide more convenience with coverage for things like bedside companions and accommodation expenses for travel companions. You can travel freely without worrying about what a condition or accident might cost you.

What Is Medical Evacuation Insurance?

Medical evacuation insurance — also called repatriation insurance — covers the costs associated with medical transportation, such as emergency helicopter rides and escort services for flights. It is usually included in comprehensive travel insurance, although the maximum amount of coverage will vary by plan.

This kind of insurance is especially important when traveling internationally or to remote areas because health insurance plans typically do not cover these expenses. For example, say you need medical service while overseas. Even if you have health coverage internationally, the cost of an air ambulance may still be considered out-of-network, so you would be responsible for the majority of that bill.

The price of medical evacuation insurance can easily reach hundreds of thousands of dollars and put significant strain on your budget. For example, the average cost of emergency medical transportation to the U.S. from Asia ranges from $165,000 to $225,000. These prices can vary based on the medical condition and the area. If you are going to a far-away region, you may need to obtain higher levels of coverage.

Keep in mind that medical evacuation insurance does not cover the costs of the medical treatment itself, just the transportation. The plan may pay for treatment in the air or from a medical professional accompanying you.

For most travelers, medical evacuation insurance is critical. Check with your health plan to see if you have any global coverage and whether it is considered out-of-network. Remember that Medicare is not accepted abroad. Even if you are staying in the U.S., consider how close you will be to regular transportation methods. The further you are from medical care and your home, the more expensive it will likely be to get transportation. Adventurous trips, like skiing or hiking in remote places, could still require emergency transportation.

Another factor that makes medical evacuation especially important is any existing medical conditions you may have. Some conditions can make commercial flights more challenging, necessitating assistance or alternative transit options. You may need or benefit from medical air transport, for instance, if you or your traveling companions have:

- A compromised immune system.

- A chronic health condition that needs constant care and monitoring.

- A mental health condition that calls for a less-stimulating environment while flying.

- A medical condition that makes flying commercially challenging.

Medical evacuation insurance can be especially helpful in these scenarios to offer support or alternative services during transit.

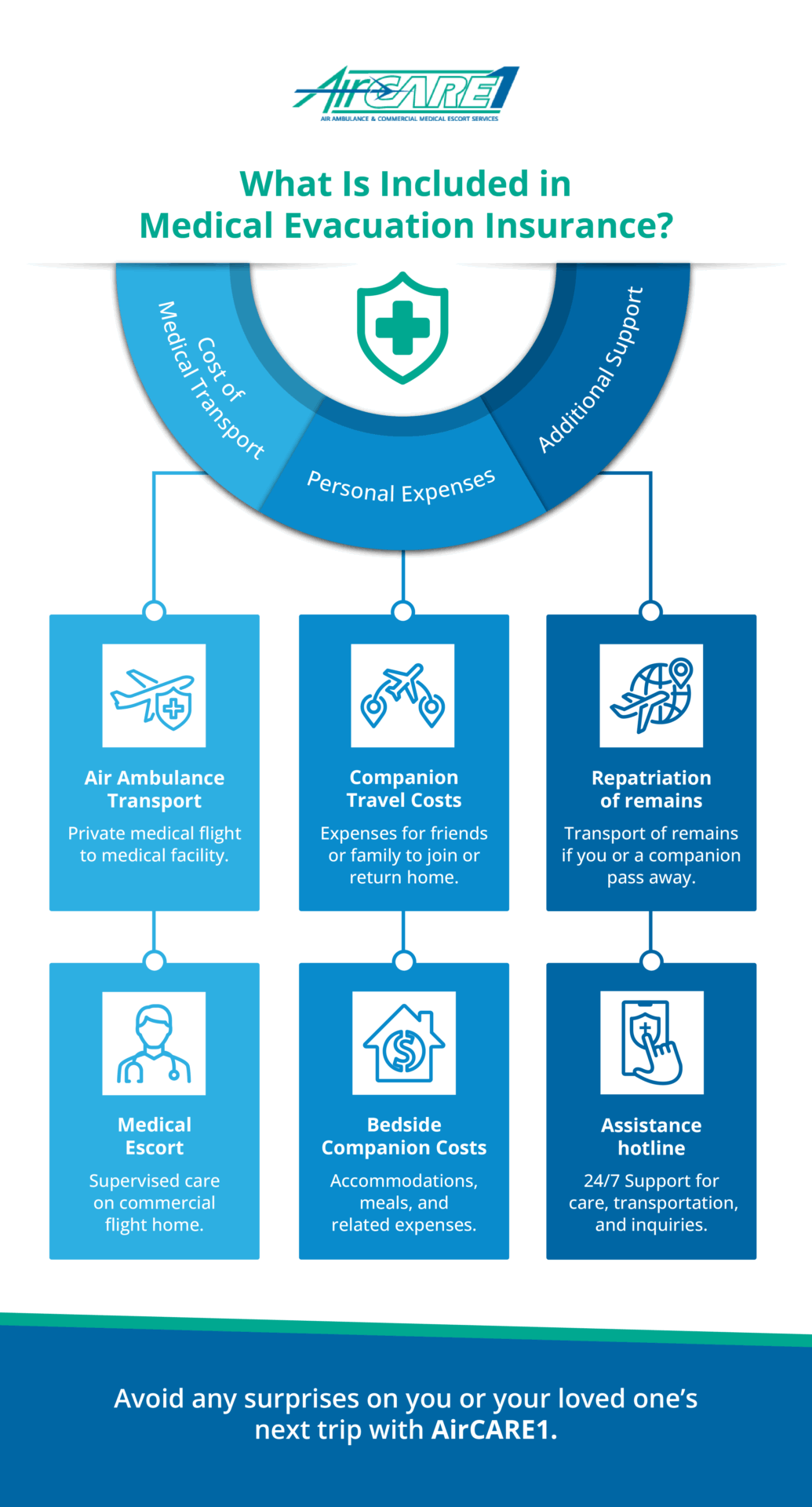

What Is Included in Medical Evacuation Insurance?

Although every plan will be different, here are some of the services you can expect to be covered under most insurance plans.

1. Emergency Transportation

A medical evacuation insurance plan can cover the costs of any emergency transportation to a location where you can get appropriate treatment for a serious illness or injury. This might be all the way back in the U.S. or an adequate location closer to you. If you get treated in the U.S., this service can pay for the flight home, whether that is immediately or after you receive treatment and need to recover.

Medical air transports offer the guidance of trained medical professionals, which may be needed for a wide range of conditions, should a doctor recommend it. Some transports, like AirCARE1, can even fly specialty teams for certain patients, such as neonatal, pediatric, geriatric, or bariatric patients. Other patients that may require emergency transportation include:

- Trauma patients.

- Cardiac patients on intra-aortic balloon pumps (IABP).

- Respiratory patients on ventilators.

- Patients with multiple IV drips.

- Neurological patients with head injuries requiring intra-cranial monitoring.

Other situations requiring emergency transportation might include critical illness or injuries during transit, the need for specialized care at another facility, or a premature birth out of the mother’s home country or state.

2. Medical Escort on Return Home

Medical escort services can cover the care costs if you require specialized care for the flight home. For instance, you may need a medical professional’s help to administer oxygen or medication during a flight.

3. Costs for Traveling Companions

Medical evacuation insurance can also cover the costs of helping friends or family members travel to you or back home. If, for example, you get hospitalized overseas, it can cover the cost of flights and hotel rooms to bring a family member or friend over to you. This benefit might require a hospital stay of a specific length. The plan might not pay if you only stay for a few nights.

If you are traveling with children and get hospitalized, the plan may also cover the cost of flying them home. It could help you arrange escorts during the flight and accommodations during the trip.

4. Costs for a Bedside Companion

If you need someone to help you with bedside care, some medical evacuation benefits will cover expenses for accommodations, meals, and other costs associated with your companion while they stay and take care of you.

5. Repatriation of Remains

If you or a traveling companion die during your trip, medical evacuation insurance may also cover the cost of transporting the remains home. These may be called repatriation benefits.

6. Assistance Hotline

Some medical evacuation insurance will even include 24/7 assistance. You will likely have a staff line of professionals who can help answer questions and arrange care and transportation. They can also help find services in-network with your insurance carrier. You can usually contact them via phone or the insurance company’s app.

Get a Medical Evacuation Quote From AirCARE1

Understanding your travel costs can help you make an informed decision about medical care and the risk of not getting medical evacuation insurance. You do not know what will happen next, but a little preparation can help you get the quality care you need in a stressful situation. If you have an upcoming trip, make sure you know your costs and find the right evacuation service for your needs.

AirCARE1 offers reliable, personalized medical care from experienced professionals who strive to make a difference in patients’ lives. Our supportive team takes every precaution to keep patients safe and get them to their destination. Reach out to us today to get a quote and avoid any surprises on your or your loved one’s next trip.

Linked Sources: